Making sense of

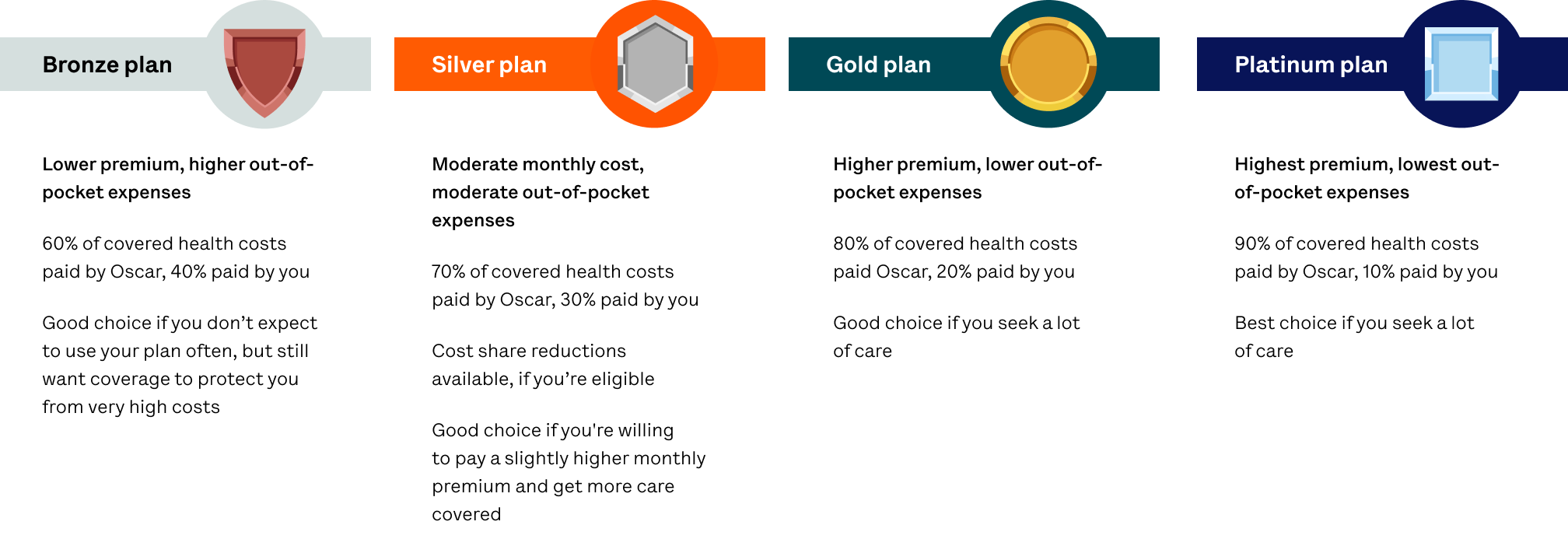

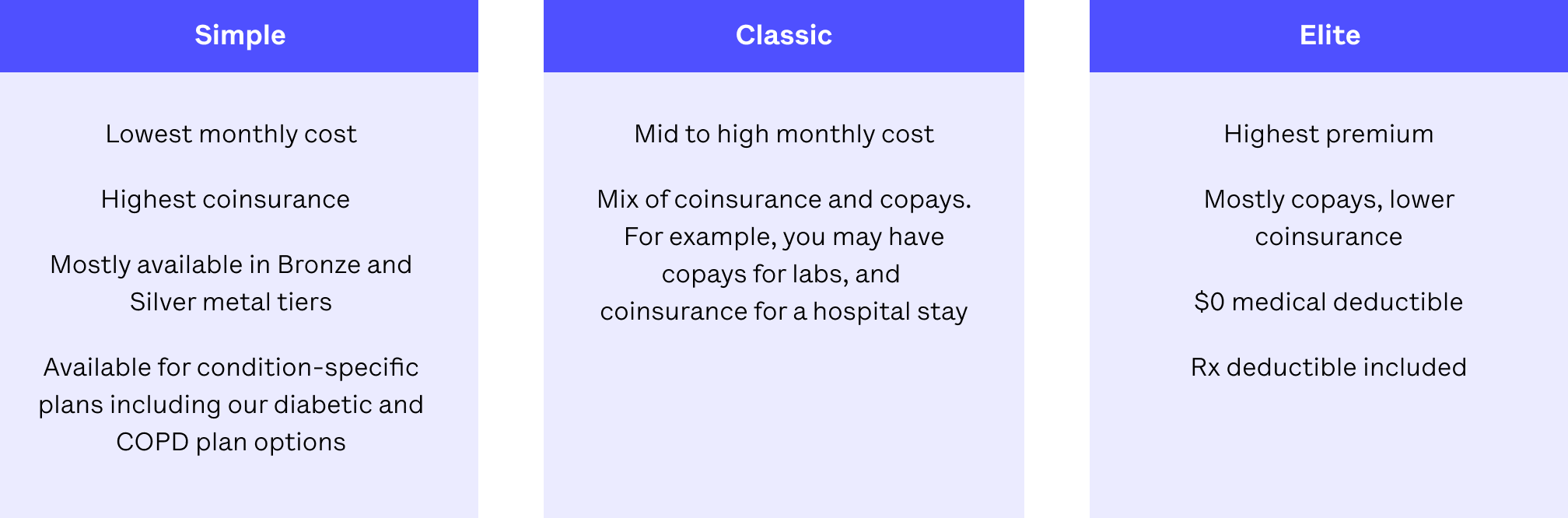

health insurance

Learn what you need to know to find an individual and family plan that’s right for you. We’ll break down the Affordable Care Act (ACA), how the plans work, and your best options with Corvia Health.

Find a plan